Three Tips to Manage Conflict During Mergers & Acquisitions

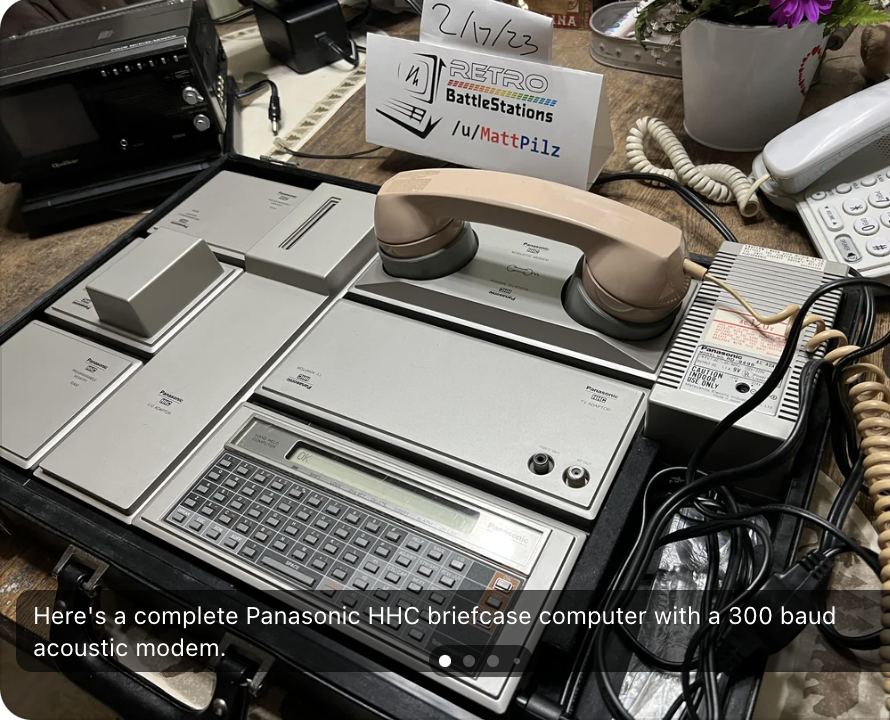

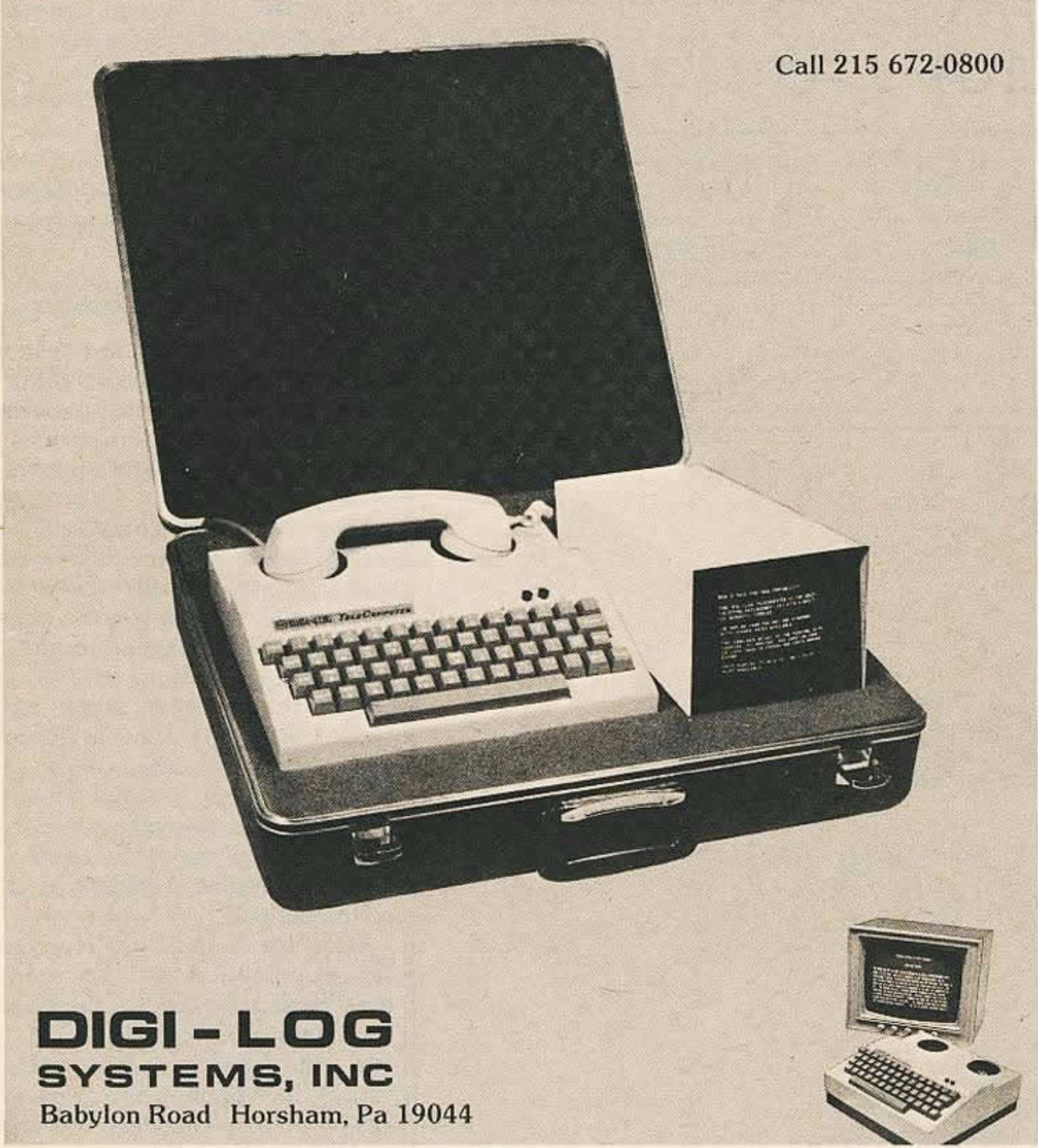

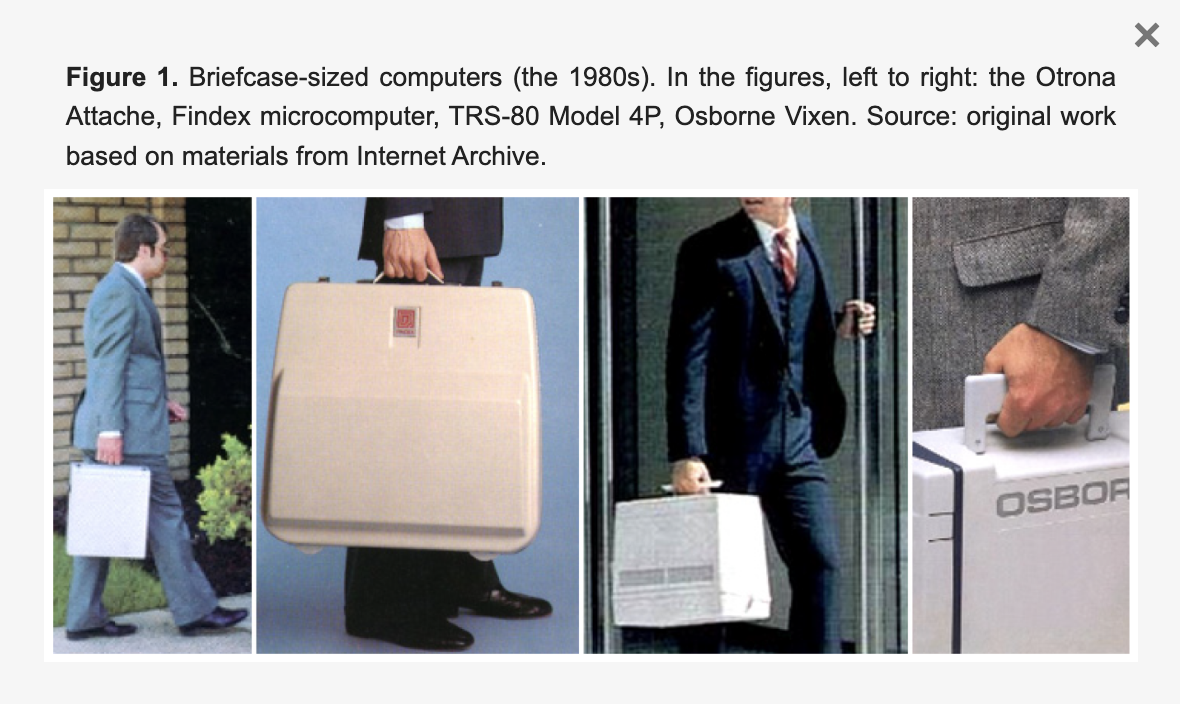

I have a clear memory of my dad, in dress pants and dress shirt and suspenders, tie off, collar open, making phone call after phone call and typing emails… in the 1980s, in this briefcase that had a modem inside and connected directly to our landline.

Incidentally, if anyone out there has a picture of this contraption, I would love to see it! Couldn't find one that looks like what my eight-year-old-self remembered - but these come close…

My dad worked at a bank called Irving Trust, and they were being bought out by Bank of New York.

Nothing my dad or his colleagues did changed the acquisition, but the stress he experienced during the process was real. And yes, he brought it home to his wife and kids - because human beings are not robots.

Today, I advise leaders on handling conflicts at work - and I cannot count how many times people have said to me, “you should work with M&A companies!”

Sadly, none have reached out for my services…yet.

Recently I got to contribute to a LinkedIn AI (*ahem* I mean collaborative) article about handling conflicts during mergers and acquisitions.

Change and Conflict

The truth is, there’s not much that an expert would recommend for a merger or acquisition situation that’s all that different from other conflict situations, or any work-related change process. Change produces stress, and stress can lead to conflict - partly because when we’re stressed, all our interpersonal skills seem to just fly right on out the window.

But we know this. Not only are we already aware of change management processes, we also know to take extra time and patience and grace with people when they are stressed.

With great communication, transparency, and compassion, you can calm down conflicts that come up during mergers and acquisitions just like in any other change process an organization is dealing with.

Three Tips for Conflicts in Mergers & Acquisitions

Here are three essential steps for managing conflicts (and stress) during a merger or acquisition:

Be curious.

Make sure you understand what’s going on that appears to be a conflict, and who’s involved in the conflict. With mergers and acquisitions, issues may come up related to a wide variety of factors:

Divergent expectations,

Cultural differences (work, ethnic, and geographic cultures - and subcultures),

Identity and loyalty related to the organization, and

Power struggles - whether coming from a place of protection, fear, or just plain desire for power.

Communicate as clearly and as transparently as possible.

Of course full transparency is rarely possible, but be honest with folks about what can be shared, what can’t be shared, and what is still a genuine unknown.

Overcommunicating what you do know is fruitful - and use every mode of communication. Give the same information in-person, via text/Slack/chat, via email, and in other written forms. Give the same information to small groups as to the whole organization.

Make sure you’re sharing:

If the take-over is something the leadership wants, and why;

What other options may exist for the company, and how those options would affect employees;

Acknowledgement of the stress, fear, and complicated feelings the whole process is likely to bring up in people.

Also clearly communicate what common ground exists - between the organizations, between the leaders, between the employees. Are benefits similar? Do both organizations value in-person gatherings? Do people know how much money or market share stands to be gained or lost?

Talk about the impact of doing nothing.

Whether you’re in an M&A situation or some other type of conflict, there’s typically an option to do nothing. Some folks embrace this, preferring the status quo and assuming that if nothing is done then nothing changes. That’s not always true, particularly in an acquisition. Some folks ignore this and think they MUST do something - which is really only true some of the time.

If you’re facing a merger or an acquisition, talk to your own experts - those you trust who work in this field - about every possible outcome. Ask questions you don’t want to know the answer to. Consider what it would mean if you - and your company - did nothing. Then decide if it’s worthwhile to do nothing, but be clear with your people about having considered the option, no matter what you decide.

I was only seven or eight when my dad’s bank was taken over, so I definitely don’t remember much beyond thinking it was so cool that he could just plug the old landline into his briefcase and then do work.

Hm: Was I the only elementary school kid thinking it was cool for her dad to work at home in the ‘80s? And to be clear - “work at home” here means he worked at home after dinner, after putting in a full day at the office.

The Impact of Acquisitions on Employee Sense of Identity

I do remember that a decade after, while still employed at the same physical location, my dad would get together regularly with “the old Irving team” - a small group of people he trusted in a deeper way than any of his other colleagues. They had banded together and fought something bigger than themselves - they lost - but the experience brought them closer together.

That feeling of being part of a separate team lasted until he retired.

He worked at the World Trade Center, and was there on September 11, 2001 - and yet - even the impact of that tremendous event didn’t seem to change his identity as an “Irving man.”

If your company is going through a merger or acquisition, give serious - and early - consideration to how the new company will function in the end. Do you really want two separate groups of people who believe they are fundamentally different?

If you need someone to help you figure out a version of team-building that means two groups of people from different companies are now stuck together and have to figure out how to work together… we’re here for you. Schedule a consultation.